The General Department of Taxation guides the use of e-receipts as follows:

Although, in accordance with the Decree No. 123/2020/ND-CP, from July 01, 2022, organizations may use e-receipt. However, the standard format of e-receipts and implementation procedures.

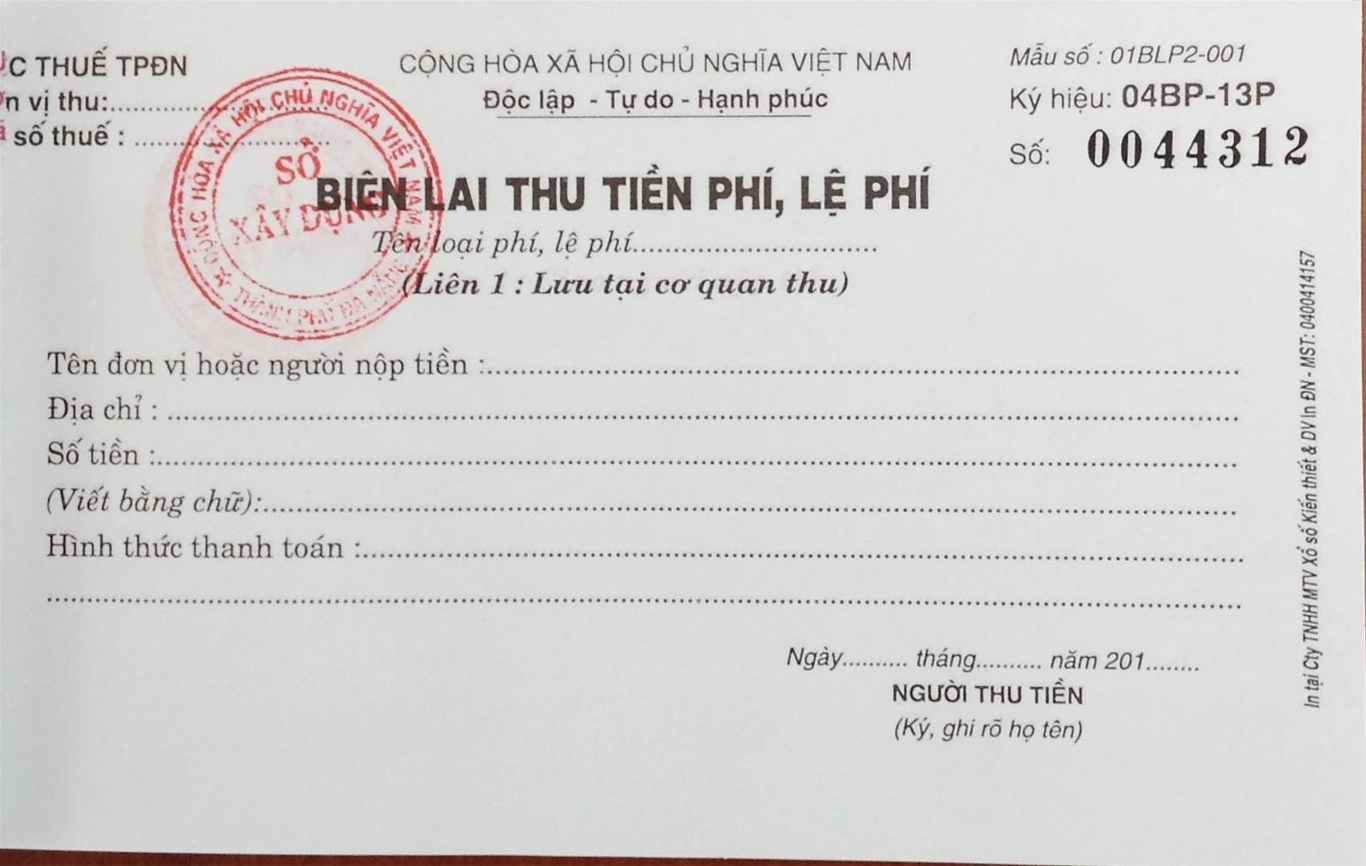

Therefore, organizations, including organizations authorized to collect taxes, shall continue to use paper receipts printed on order or self-printed or purchased from tax offices, or use e-receipts under Circular No. 32/2011/TT-BTC.

Regarding the use of electronic personal income tax (PIT) withholding documents:

Pursuant to Article 33 of Decree No. 123/2020/ND-CP, tax-withholding organizations are not required to register or notify the issuance, or transfer of e-data to tax offices when using electronic PIT withholding documents. They shall develop a software system themselves to ensure that the used e-documents.

While pending the use of electronic PIT withholding documents, organizations and enterprises may use self-issued PIT withholding documents.

RSS

RSS