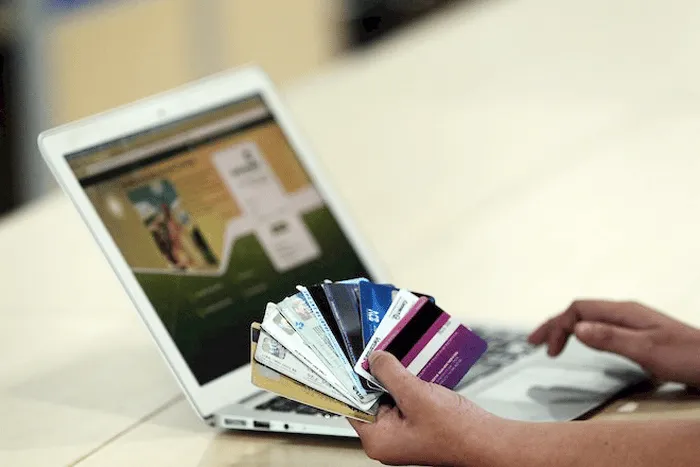

Accordingly, the Charges and fees shall be paid to charge- and fee-collecting organizations or the State Treasury by the forms such as: Directly in cash or via credit institutions, service providers or by other methods in accordance with law.

Based on the nature and characteristics of each charge or fee, competent state agencies specified in Clause 2 Article 4 of the Law on Charges and Fees shall determine appropriate payment methods, declaration and payment periods.

On a daily, weekly or monthly basis, charge-collecting organizations shall deposit charge revenues into an account of charge revenues pending remittance into the state budget;

fee-collecting organizations shall deposit fee revenues into an account of fee revenues pending remittance into the state budget or deposit fee revenues into an account of state budget revenues opened at State Treasury.

After considering whether the charge or fee revenue is small or large and whether the distance from the charge or fee collection place to a state treasury is long or short, competent state agencies shall decide whether such charge-collecting organization deposits charge revenues into the account of charge revenues pending remittance into the state budget

Decree No. 82/2023/ND-CP takes effect on January 12, 2024.

RSS

RSS