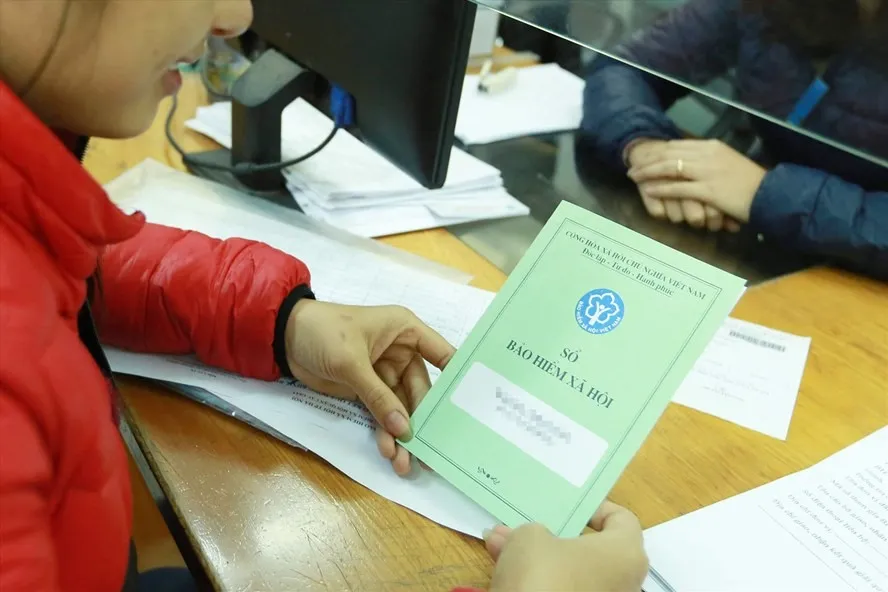

Recently, Social Security Offices of provinces and centrally-run cities have taken different solutions to urge the collection and reduction of the amount of late payment of social insurance, health insurance, and unemployment insurance premiums (hereinafter referred to as social insurance).

Therefore, by the end of 2022, the late payment rate of such units accounted for only 2.91% of the receivable sum, which is the lowest rate of late payment ever. This is the lowest late payment rate.

To continue to ensure the interests of employees and reduce the amount of late payment of social insurance contributions to the lowest rate, Vietnam Social Security requires Directors of provincial Social Security Offices and relevant units to implement a number of measures as follows:

- To strictly follow regulations and procedures for managing the collection of Vietnam Social Security; improve the responsibility of the head, and assign specific tasks and responsibilities to staff. On a monthly basis, to inform and notify results of social insurance contributions to employers and employees for timely and sufficient contribution of social insurance.

- An urgent notice shall be sent to an employer with late payment from one month to less than three months. In case an employer fails to make payment, a record of violations shall be made according to regulations.

- In case an employer delays its payment from 3 months or more, the irregular specialized inspections shall be organized, and fines shall be imposed for acts of administrative violations; the enforcement of decisions to sanction administrative violations shall be conducted if the employer fails to follow the inspection conclusion.

- To make and publicize the list of units with late payment that have received urgent notices, or have been irregularly inspected, and units with administrative violations that intentionally refuse to make social insurance contributions, on local and central mass media.

See the full text at the Official Dispatch No. 479/BHXH-TST.

RSS

RSS