https://image.luatvietnam.vn/uploaded/Others/2023/01/04/LEGAL_CALENDER_2023_0401155005.pdf

(Click for details)

|

Time |

Must-to-do works |

Legal basis |

|

|

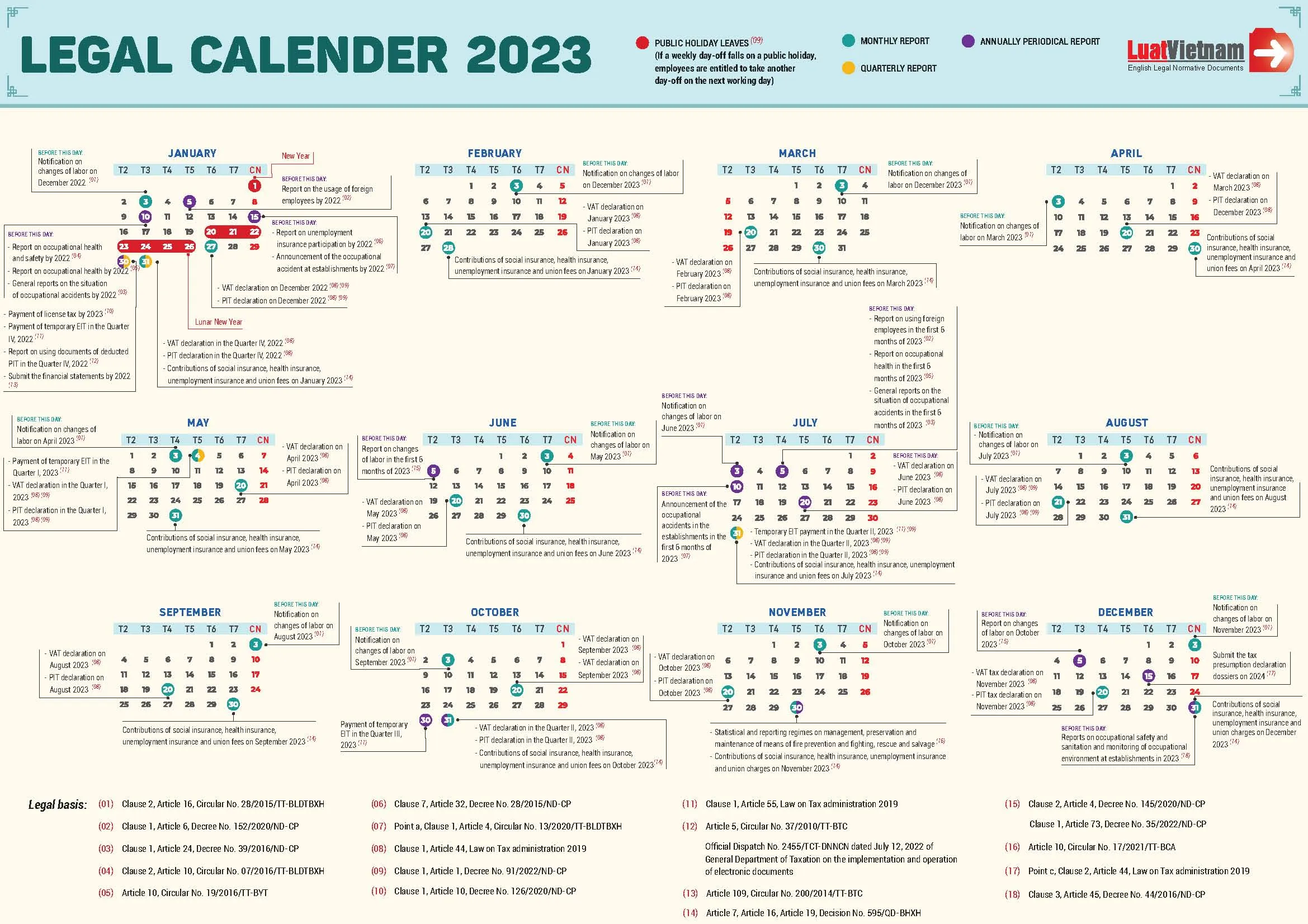

JANUARY |

Before January 01 |

Before this day: Notification on changes of labor on December 2022 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

Before January 05 |

Before this day: Report on the usage of foreign employees by 2022 |

(02) Clause 1, Article 6, Decree No. 152/2020/ND-CP |

|

|

Before January 10 |

Before this day: - General reports on the situation of occupational accidents by 2022 |

(03) Clause 1, Article 24, Decree No. 39/2016/ND-CP |

|

|

- Report on occupational health and safety by 2022 |

(04) Clause 2, Article 10, Circular No. 07/2016/TT-BLDTBXH |

||

|

- Report on occupational health by 2022 |

(05) Article 10, Circular No. 19/2016/TT-BYT |

||

|

Before January 15 |

Before this day: - Report on unemployment insurance participation by 2022 |

(06) Clause 7, Article 32, Decree No. 28/2015/ND-CP |

|

|

- Announcement of the occupational accident at establishments by 2022 |

(07) Point a, Clause 1, Article 4, Circular No. 13/2020/TT-BLDTBXH |

||

|

January 27 |

- VAT declaration on December 2022 - PIT declaration on December 2022 |

(08) Clause 1, Article 44, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

|

|

January 30 |

- Payment of license tax by 2023 |

(10) Clause 1, Article 10, Decree No. 126/2020/ND-CP |

|

|

- Payment of temporary EIT in the Quarter IV, 2022 |

(11) Clause 1, Article 55, Law on Tax administration 2019 |

||

|

- Report on using documents of deducted PIT in the Quarter IV, 2022 |

(12) - Article 5, Circular No. 37/2010/TT-BTC Official Dispatch No. 2455/TCT-DNNCN dated July 12, 2022 of General Department of Taxation on the implementation and operation of electronic documents |

||

|

- Submit the financial statements by 2022 |

(13) Article 109, Circular No. 200/2014/TT-BTC |

||

|

January 31 |

- VAT declaration in the Quarter IV, 2022 - PIT declaration in the Quarter IV, 2022 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

Contributions of social insurance, health insurance, unemployment insurance and union fees on January 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

||

|

FEBRUARY |

Before February 03 |

Before this day: Notification on changes of labor on December 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

February 20 |

- VAT declaration on January 2023 - PIT declaration on January 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

February 28 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on January 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

MARCH |

Before March 03 |

Before this day: Notification on changes of labor on December 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

March 20 |

- VAT declaration on February 2023 - PIT declaration on February 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

March 30 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on March 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

APRIL

|

Before April 03 |

Before this day: Notification on changes of labor on March 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

April 20 |

- VAT declaration on March 2023 - PIT declaration on December 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

April 30 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on April 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

MAY |

Before May 03 |

Before this day: Notification on changes of labor on April 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

May 04 |

- Payment of temporary EIT in the Quarter I, 2023 |

(11) Clause 1, Article 55, Law on Tax administration 2019 |

|

|

- VAT declaration in the Quarter I, 2023 - PIT declaration in the Quarter I, 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

||

|

May 20 |

- VAT declaration on April 2023 - PIT declaration on April 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

May 31 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on May 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

JUNE

|

Before June 03 |

Before this day: Notification on changes of labor on May 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

Before June 05 |

Report on changes of labor in the first 6 months of 2023 |

(15) - Clause 2, Article 4, Decree No. 145/2020/ND-CP - Clause 1, Article 73, Decree No. 35/2022/ND-CP |

|

|

June 20 |

- VAT declaration on May 2023 - PIT declaration on May 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

June 30 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on June 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

JULY |

Before July 03 |

Before this day: Notification on changes of labor on June 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

Before July 05 |

Before this day: - Report on using foreign employees in the first 6 months of 2023 |

(02) Clause 1, Article 6, Decree No. 152/2020/ND-CP |

|

|

- Report on occupational health in the first 6 months of 2023 |

(05) Article 10, Circular No. 19/2016/TT-BYT |

||

|

- General reports on the situation of occupational accidents in the first 6 months of 2023 |

(03) Clause 1, Article 24, Decree No. 39/2016/ND-CP |

||

|

Before July 10 |

Before this day: Announcement of the occupational accidents in the establishments in the first 6 months of 2023 |

(07) Article 4. Circular No. 13/2020/TT-BLDTBXH |

|

|

July 20 |

- VAT declaration on June 2023 - PIT declaration on June 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

July 31 |

- Temporary EIT payment in the Quarter II, 2023 |

(11) Clause 1, Article 55, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

|

|

- VAT declaration in the Quarter II, 2023 - PIT declaration in the Quarter II, 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

||

|

- Contributions of social insurance, health insurance, unemployment insurance and union fees on July 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

||

|

AUGUST |

Before August 03 |

Before this day: Notification on changes of labor on July 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

August 21 |

- VAT declaration on July 2023 - PIT declaration on July 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

|

|

August 31 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on August 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

SEPTEMBER |

Before September 03 |

Before this day: Notification on changes of labor on August 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

September 20 |

- VAT declaration on August 2023 - PIT declaration on August 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

|

|

September 30 |

Contributions of social insurance, health insurance, unemployment insurance and union fees on September 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

OCTOBER |

Before October 03 |

Before this day: Notification on changes of labor on September 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

October 20 |

- VAT declaration on September 2023 - VAT declaration on September 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 (09) Clause 1, Article 1, Decree No. 91/2022/ND-CP |

|

|

October 30 |

Payment of temporary EIT in the Quarter III, 2023 |

(11) Clause 1, Article 55, Law on Tax administration 2019 |

|

|

October 31 |

- VAT declaration in the Quarter II, 2023 - PIT declaration in the Quarter II, 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

- Contributions of social insurance, health insurance, unemployment insurance and union fees on October 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

||

|

NOVEMBER |

Before November 03 |

Before this day: Notification on changes of labor on October 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

November 20 |

- VAT declaration on October 2023 - PIT declaration on October 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

November 30 |

Statistical and reporting regimes on management, preservation and maintenance of means of fire prevention and fighting, rescue and salvage |

(16) Article 10, Circular No. 17/2021/TT-BCA |

|

|

November 30 |

- Contributions of social insurance, health insurance, unemployment insurance and union charges on November 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

|

DECEMBER |

Before December 03 |

Before this day: Notification on changes of labor on November 2023 |

(01) Clause 2, Article 16, Circular No. 28/2015/TT-BLDTBXH |

|

Before December 05 |

Before this day: Report on changes of labor on October 2023 |

(15) - Clause 2, Article 4, Decree No. 145/2020/ND-CP - Clause 1, Article 73, Decree No. 35/2022/ND-CP |

|

|

December 15 |

Submit the tax presumption declaration dossiers on 2024 |

(17) Point c, Clause 2, Article 44, Law on Tax administration 2019 |

|

|

December 20 |

- VAT tax declaration on November 2023 - PIT tax declaration on November 2023 |

(08) Clause 1, Article 44, Law on Tax administration 2019 |

|

|

Before December 31 |

Before this day: Reports on occupational safety and sanitation and monitoring of occupational environment at establishments in 2023 |

(18) Clause 3, Article 45, Decree No. 44/2016/ND-CP |

|

|

December 31 |

Contributions of social insurance, health insurance, unemployment insurance and union charges on December 2023 |

(14) Article 7, Article 16, Article 19, Decision No. 595/QD-BHXH |

|

RSS

RSS