What types of businesses must have permits?

In accordance with regulations at Article 7, the Commercial Law 2005, traders are obliged to register their business according to the provisions of law. Where traders have not yet registered their business, they are still held responsible for all of their activities.

Within that, traders who are the individuals and organizations have commercial activities in the independent and frequent ways, having business registration and operates in the industries and localities with the forms which are not banned by legal provisions.

Currently, there are many forms of business such as individuals, cooperatives, business establishment, households... Businesses and households are the most popular forms. And the business registration obligations are prescribed as follow:

- To fully and timely perform the obligations related to enterprise registration, registration of changes in enterprise registration contents (Clause 2, Article 8, Enterprise Law 2020).

- Households engaged in agriculture, forestry, aquaculture or salt production, peddlers, petty food sellers, shipment-based traders, itinerant and... are not required to make business household registration, unless they are engaged in sectors or trades subject to conditional business investment (Clause 2, Article 79, Decree No. 01/2021/ND-CP).

Traders in street trading, petty trading, petty-food trading, the consignment trading, polishing shoes, selling lottery tickets, repairing key, repairing vehicles...not be called as “trader” (Clause 1, Article 3, Decree No. 39/2007/ND-CP)...

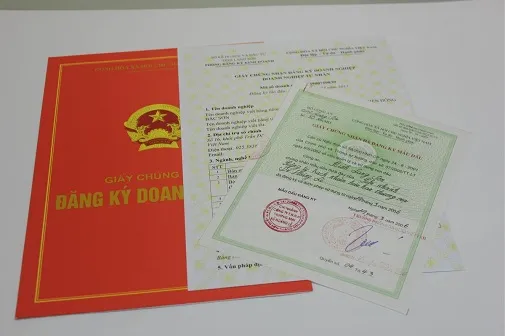

Therefore, apart from above cases, all other cases must make business registration. Organizations and individuals shall be granted with the Business Registration Certificate (for enterprises); Household Registration Certificate (for households).

What are the fines for doing business without permits?

In accordance with the Decree No. 122/2021/ND-CP, the fines for violations in business registration shall be applied as follows:|

No. |

Acts |

Fine |

Pursuant to |

|

1 |

Doing business as an enterprise without applying for enterprise registration; |

VND 50 million - VND 100 million. - Must register business establishment |

Point a, Clause 4, Article 46 |

|

2 |

Carrying on business operation after the enterprise registration certificate has been revoked or while the enterprise is requested to suspend or terminate its business operation |

|

Point b, Clause 4, Article 46 |

|

3 |

Carrying on a conditional business line after a suspension has been requested by the business registration authority; |

VND 15 million - VND 20 million. |

Point a, Clause 2, Article 48 |

|

4 |

- For establishing a household business despite not having the right to establish household businesses; or - For failure to apply for household business registration where the registration is compulsory as prescribed; |

VND 05 million - VND 10 million. |

Point b, c Clause 1, Article 62 |

|

5 |

Carrying on a conditional business line after a suspension has been requested by the district-level business registration authority; |

VND 10 million - VND 20 million. |

Point b, Clause 2, Article 62 |

|

6 |

Suspending or resuming business ahead of schedule without sending a written notification to the district-level business registration authority where the household business is registered |

VND 05 million - VND 10 million. |

Point c, Clause 1, Article 63 |

In conclusion, above are the fines for doing business without certificates. The procedure for business registration is not too complicated so organizations and individuals should make as soon as possible.

RSS

RSS